Fix & Flip Bridge Loan

We Fund, You Rehab and Your Community Prospers With Our Bridge Loans

Fix & Flip Loan

In Search of Short-Term Financing to Fund Your Next Flip?

CMC’s Fix and Flip loans are the perfect solution for real estate investors looking to purchase properties under market value, rehab them, and then re-sell as quickly as possible. Our loans are designed to give you the speed and flexibility you need to capitalize on opportunities in the market.

Why Choose CMC’s Fix & Flip Loans?

Key Features:

- Purchase Below Market Value: Secure properties at a discount and unlock their potential with our tailored financing.

- Fast & Flexible Funding: Obtain the capital you need quickly, so you can start your rehab project without delay.

- Designed for Quick Turnaround: Our loans are structured to support the fast-paced nature of fix and flip projects, allowing you to re-sell and profit as soon as possible.

Light Documentation

Our loan process allows real estate investors to avoid the intrusive document-gathering and mountains of endless paperwork typically found with other lending institutions. We do not require income verification, tax returns, months and years of bank statements, or many of the other typical requests from other lenders. We have a quick and straightforward condition list that can be completed fast – allowing our investors to focus on their properties rather than the hassle of tracking down and providing infinite documents and files.

FAQs

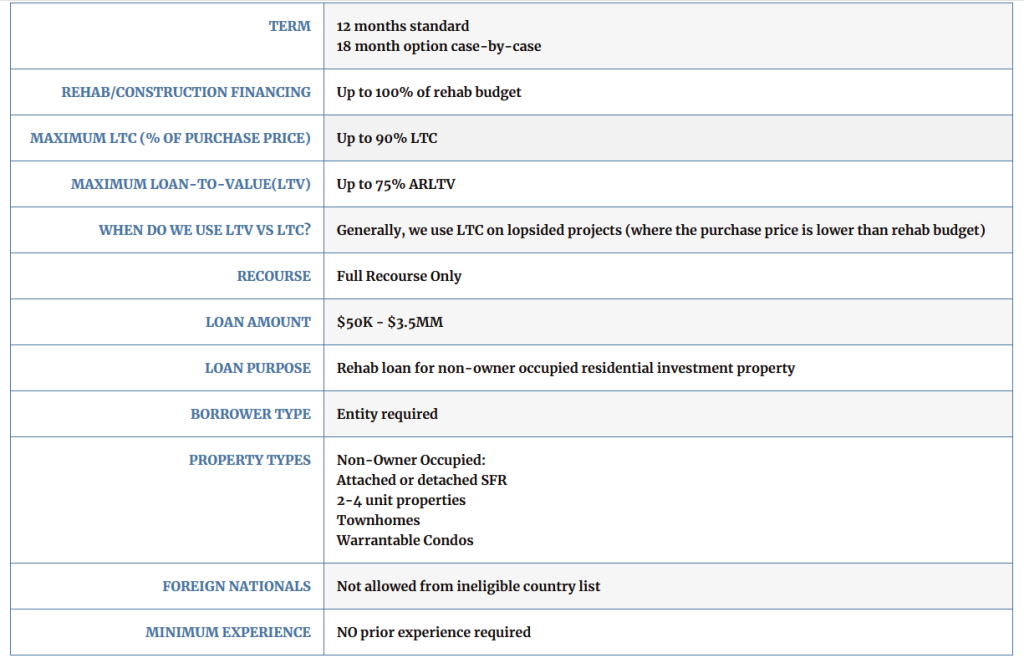

Fix and flip loans are credit lines used to cover the purchase price and rehab costs of residential investment properties. These fix and flip loans are meant for short-term rehab projects, with term lengths up to 18 months.

Fix and flip loans are for real estate investors who plan to rehabilitate and resell their investment properties. They are not for long-term investment properties, or properties with more than 4 units on site. If you have more than 4 units on the property, check out our Multifamily program.

Chambliss Mortgage Capita's Fix and flip loan program is simple, and that's what sets us apart. We know the business inside and out so we get you started on your project sooner through streamlined approvals and personalized service from start to finish.

A bridge loan is short term financing used until permanent financing is secured. These types of loans are common in real estate transactions and typically range from 6-18 months. Bridge loans are backed by some form of collateral, usually the subject property.