1-4 Units Stabilized Bridge Loan

We Fund, You Grow Assets and Your Community Prospers

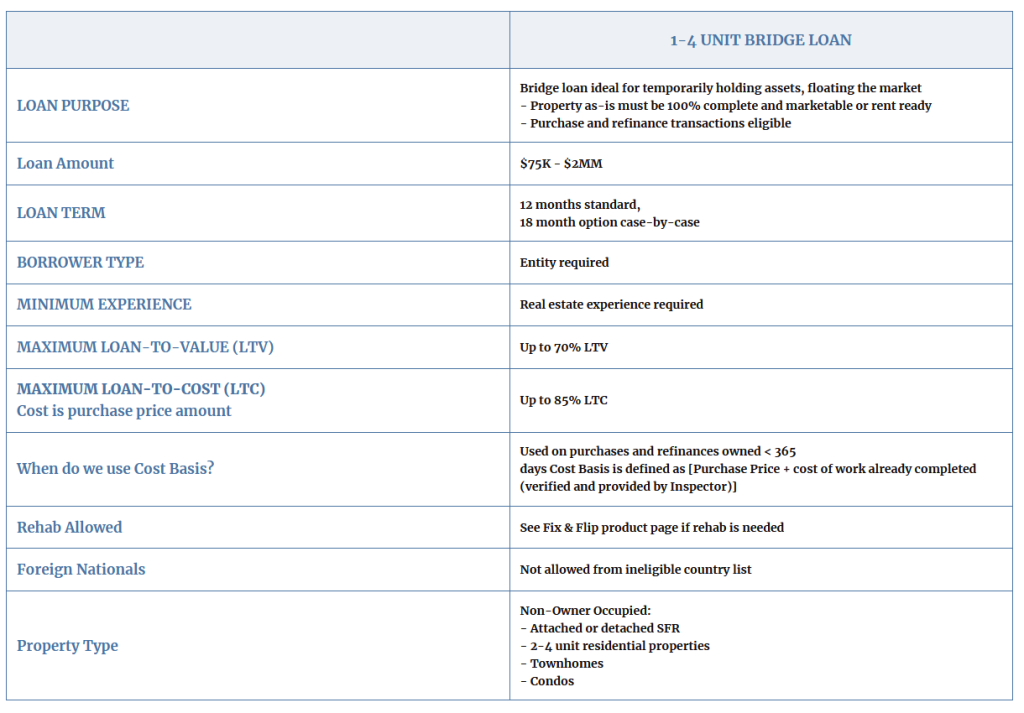

1-4 Unit Bridge Loan

Need Short-Term Financing for Your Investment Property?

If you’re looking to fund a short-term loan on an investment property, our Bridge Loan program provides you with the flexibility you need. Whether you’re acquiring a new property, refinancing an existing one, or need a temporary financing solution, our Bridge Loans offer quick access to capital, allowing you to seize opportunities without delay.

Why Choose CMC’s Bridge Loans?

Key Features:

- Quick & Flexible Financing: Obtain fast funding to cover short-term needs, ensuring you never miss out on a promising investment.

- Ideal for Transitional Situations: Use our Bridge Loans to manage transitions, such as purchasing a property before selling another or securing a new loan.

- Tailored to Your Needs: Our Bridge Loans are designed with flexible terms to match your specific project timeline and goals.

- 12- or 18-month (case-by-case) property loan terms

- No experience required

- Minimum 660 FICO

Bridge the Gap with Confidence

Apply now to learn more about how CMC’s Bridge Loan program can provide the flexibility you need to navigate your next investment property transaction successfully.

FAQs

We can refinance properties at any time, but the loan is structured based on the as-is value only after 12 months after the property was purchased.

Yes, vacant properties that are rent ready are eligible within this program. The in-place DSCR calculation will be based on the market rent.